USA – the IRS Targets Cryptocurrency

The IRS sets its sights on more than 10,000 cryptocurrency users who failed to report income and pay their taxes.

In late July the IRS began sending emails to over 10,000 taxpayers who may have ‘forgotten’ to report and pay income taxes for income received in cryptocurrency, in what is a change of attitude and focus from the IRS towards cryptocurrency. This change has been met with mixed feelings.

Cryptocurrency has been receiving bad press since the get go. Numerous ties to various scandals, since it entered the game, have tarnished its name and reputation. From its earliest days, cryptocurrency, perhaps the most revolutionary monetary development in recent memory, has been abused by criminals who enjoy the anonymity it allows. Famously, ‘the Silk Road’, the biggest black market trading grounds that operated in the darknet before its operators were hunted down and imprisoned, worked solely using bitcoin.

With the soaring value of bitcoin over the last few years – it is currently valued at a whopping $10,000 – it is no surprise it has attracted the attention of the Internal Revenue Service (IRS), who suspect it is used by many to avoid reporting income and paying taxes. The recent presentation of Facebook’s new cryptocurrency, Libra, has further fueled the conversation regarding the laws and rules that should be applied to cryptocurrency as it is slowly becoming an acceptable and legitimate form of payment and cryptocurrency is becoming an attractive investment for Wall Street firms.

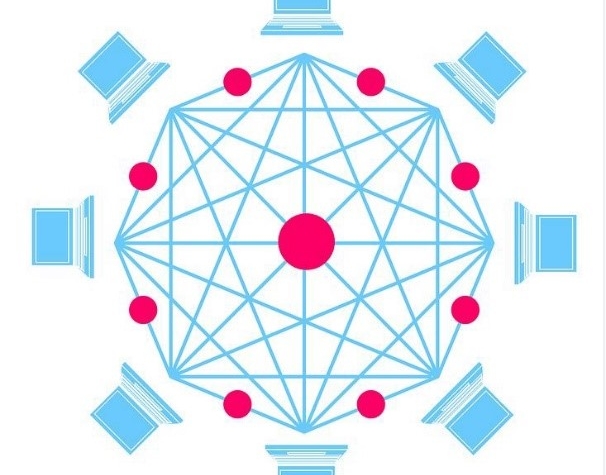

The IRS’ decision to enforce its regulations on cryptocurrency owners and deals conducted using it is welcomed by many crypto enthusiasts as a step that provides the new currency – often met with skepticism – with legitimacy and credibility. Despite the fact that most hardcore bitcoin fans tend to subscribe to libertarian values, loving the decentralized aspects of cryptocurrency led economy – they realize that this new attempt by the IRS can be seen as its defacto acceptance as an important economic player by the US authorities.